JASPER, Tenn. - Officials in Jasper say the town's current retirement plan is unsustainable.

For the last several months, the Jasper Board of Mayor and Aldermen has been finalizing procedures to terminate its plan with Nationwide Insurance and move to the Tennessee Consolidated Retirement System.

When city employees got their benefits calculations recently, many became concerned that they weren't accurate, and most of them showed up at the board's meeting last week to express their apprehensions.

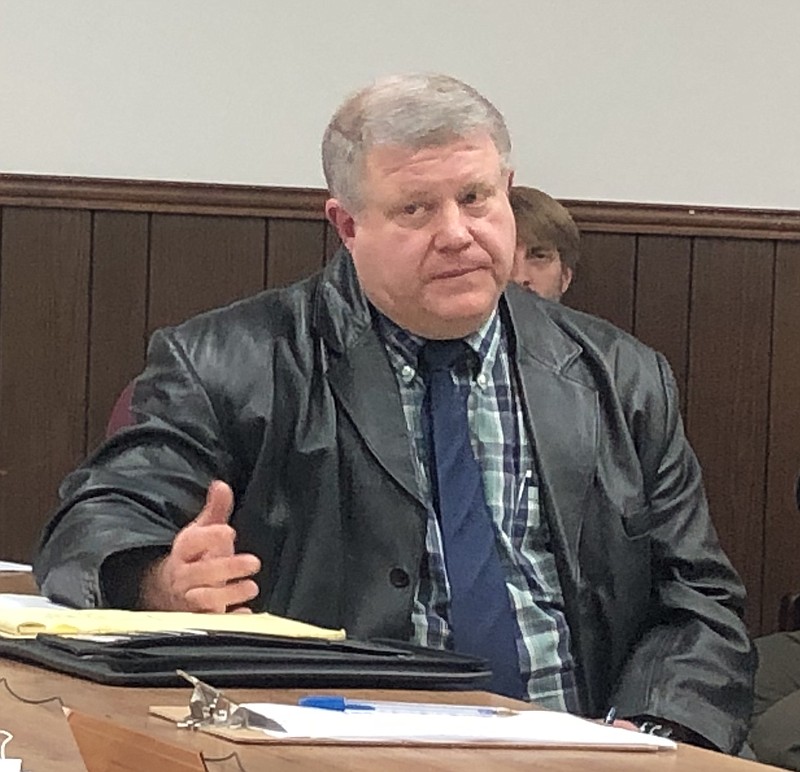

Ed Freeman, Jasper's water and sewer superintendent who has worked for the town for 40 years, said a lot of current and former employees are unhappy about "the figures on the pension plan."

"Once we received the numbers and all that, there's a lot of disagreement in what's on there and what we think should be there," he told the board.

In one example, Freeman said an employee who left the job seven years ago got as much money calculated as another who has worked there for 20 years, and they were both the same age.

"That happened," he said. "That's what we can't understand. The town is there to take care of us. We feel that we've not been took care of. I just think something's not right. The only trouble with us is we may not be asking the right questions."

Stanley, Hunt, Dupree & Rhine Inc. in Greensboro, North Carolina, has provided actuarial services for the plan since it was established in 1992, and one employee said he'd contacted them recently and was told they'd answer any questions employees had if they were face-to-face.

City Attorney Mark Raines said the "gist" of employees' concerns is that some who are close in age and number of years worked for the city have different benefit payout results.

"Some of them are double," one employee said.

Raines said he was a "lost ball in high weeds" when it comes to "high-powered retirement stuff," so the town hired Bill Robinson, an attorney in Chattanooga, and a separate actuarial to "basically check up on" Stanley, Hunt, Dupree & Rhine's work.

"To make sure that, you know, whatever calculation they performed - that they did it right," he told the employees. "I don't have the expertise to know if they did."

Raines said that Stanley, Hunt, Dupree & Rhine representatives are "hard folks to get here," and that the last time city leaders tried, board members had to travel to Greensboro for the meeting.

Alderman Jason Jennings made a motion to "pay whatever is needed" to get the actuarial company's representatives to meet personally with the town's employees.

He said if a personal visit from Stanley, Hunt, Dupree & Rhine representatives would make the town's employees more comfortable, the board should vote to fund it.

The board voted unanimously to do so.

Raines cautioned the employees to have the calculations reviewed by a financial advisor beforehand because otherwise they wouldn't know what to ask the actuarials anyway.

"That's something that the town can't do for y'all folks," he said.

After looking at the initial calculations, Freeman said most employees still feel let down by the city, regardless of future meetings with the actuarials.

"What have we got to look forward to now?" one employee asked Mayor Paul Evans. "Everything we've got is took away from us. That's what we worked here for. We just feel we've been let down - big time."

Evans said his son is one of the affected city employees, and that he feels their pain.

"I wish we could sustain it, but our property tax rate is going to be five dollars per $100, and how many people in this town are going to be standing for that?" he said. "It's one of these damned if you do, damned if you don't."

Evans said if the city continued with the current plan, Jasper would go bankrupt.

"It's not a good situation, but it ain't going to get any better," Raines said. "That's why [the board] is having to act right now."

The current plan terminates on April 1.

Ryan Lewis is based in Marion County. Contact him at ryanlewis34@gmail.com.