The Chattanooga City Council unanimously approved a special Westside tax district Tuesday, paving the way for billions of investment in The Bend and Westside Evolves, together dubbed as One Westside.

The tax district was approved under a funding mechanism known as tax increment financing, a tax incentive zone mapped onto certain areas of the city and county to promote development and growth.

Instead of standard tax collection going toward general city and county funding, new revenues from increased property value in such districts, over a certain period of time, go toward specific, agreed upon expenses related to the development.

In the case of One Westside, the agreement is for 20 years, and new revenues would go toward essential services, public schools, infrastructure and affordable housing, among other things.

(READ MORE: Residents in Chattanooga’s Westside eager for redevelopment, worry about crime)

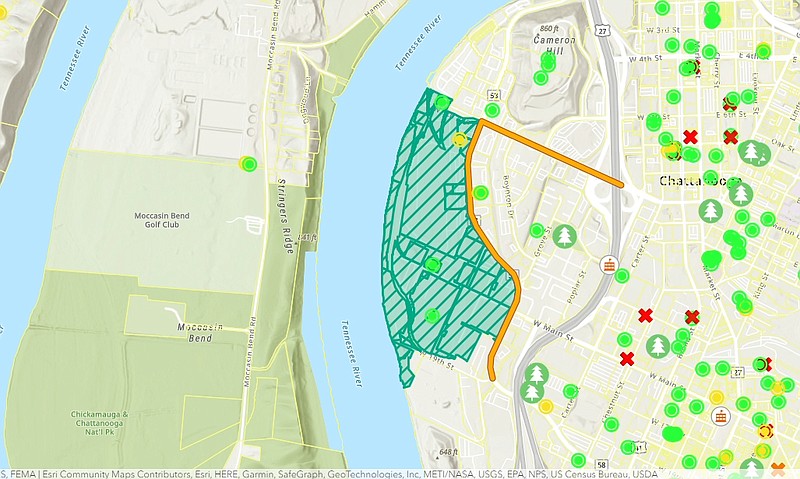

The boundary of the tax zone approved Tuesday does not include Westside Evolves, a potential $1 billion redevelopment of public housing just east of Riverfront Parkway downtown, but only The Bend, a redevelopment just west of Westside Evolves on the former Alstom tract. Development costs of The Bend could be up to $2.3 billion and would include thousands of square feet in residential, retail and commercial space.

(READ MORE: The Bend developers are trying to bring headquarters-type jobs to Chattanooga)

The boundaries of The Bend — and in turn the tax zone — are roughly M.L. King Boulevard to the north, Riverfront Parkway to the east, West 19th Street to the south and the Tennessee River to the west.

Jimmy White, president and CEO of The Bend developer Urban Story Ventures, said during a Hamilton County Commission meeting last week the tax incentives would cover about half of expected infrastructure costs.

White said in an emailed statement that it's exciting to be at this point in the tax increment financing process.

"We are thankful for the consideration and leadership shown by our elected officials and community leaders," White said. "We have a truly transformational opportunity."

Though the tax zone does not include the Westside Evolves development, which would demolish two public housing complexes — Gateway Tower and College Hill Courts — and replace them with mixed-income housing, the project and The Bend are economically tied together.

The City Council also unanimously approved allowing the Chattanooga Housing Authority to apply for a $50 million grant from the U.S. Department of Housing and Urban Development for Westside Evolves.

The grant requires the city to match the $5o million with local funds. Those funds will come from the new tax revenue agreed upon in the tax increment financing agreement.

The Hamilton County Commission is scheduled to vote on the Westside tax zone Wednesday. If the commission approves, the next step would be for the city's Industrial Development Board to vote on the plan.

New amendments

As part of the approval for The Bend plan, the City Council added and approved six amendments Tuesday. All but one of them work to ensure residents at College Hill Courts and Gateway Tower are not displaced as the Westside Evolves project moves forward.

According to a recent survey conducted by the housing authority, most residents of the complexes want to remain living on the property once redevelopment is completed.

As part of the grant agreement with the U.S. Department of Housing and Urban Development, the housing authority and Columbia Residential, the Atlanta-based firm developing Westside Evolves, must give current residents the right to return upon redevelopment at the same rental rate they currently pay, which is priced based on 30% or below the area median income.

Discussion regarding concerns over displacement of Black Chattanoogans staying in public housing has been taking place at the City Council for weeks.

Council Member Demetrus Coonrod, of Eastdale, said during the council's meeting that she approved of the amendments and liked that the discussion around ensuring residents not being displaced was being documented.

"We got proof to say, 'OK, we didn't just talk about it. It's right here to be a part of the plan,'" Coonrod said.

One of the amendments requires the housing authority update the City Council twice a year, until all 629 households at the housing complexes are permanently housed, on the relocation status of those residents. The updates also require the status of construction and financing of replacement housing.

Another amendment requires an annual survey of residents, like the one recently conducted, to determine if residents still want to stay at Westside Evolves after redevelopment.

A third amendment allows the city, under the full extent that law allows, to minimize the effects of relocation on those with mobility issues and those disabled. The housing authority's semiannual updates must also address the effect of relocation on these populations.

The fourth amendment allows the city to hire its own consultants to review the housing authority's relocation of residents while the new housing is being constructed. The U.S. Department of Housing and Urban Development covers relocation costs as part of the grant.

Concerning the right to return, there are two federal exceptions. Anyone who has been convicted of manufacturing methamphetamine on federal property or anyone with a lifetime requirement to be listed as a sexual offender does not have the right to return. The council's fifth amendment included these exceptions.

A sixth amendment, not related to the right to return, allows the city to claw back funding from the tax incentives if Hamilton County or Hamilton County Schools does not construct a downtown career and technical center, as outlined in the education funding from the tax increment financing agreement.

(READ MORE: New analysis highlights disparities in Chattanooga housing market)

Contact Ben Sessoms at bsessoms@timesfreepress.com or 423-757-6354.