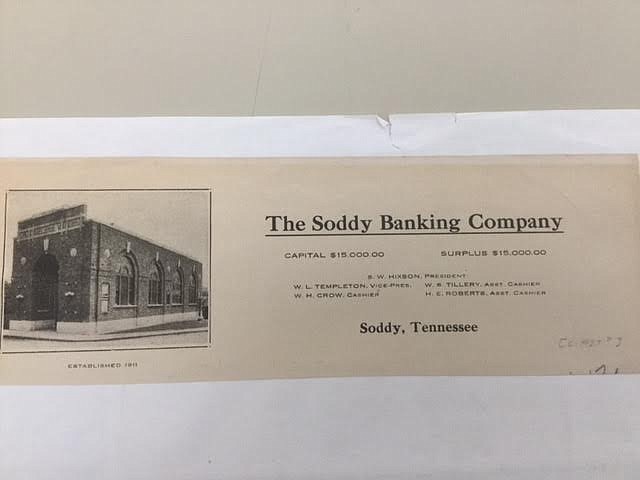

On Dec. 24, 1920, an item in the Chattanooga News announced that the Soddy Banking Company planned to erect a new building since the existing building on Wall Street had "become inadequate to handle [the bank's] increasing business." Established in 1911, the bank had "been very prosperous" for the previous few years. A story in the Chattanooga Times five years before reflected such prosperity, reporting on the impending construction of a hosiery mill, the organization of the Soddy Telephone Company, and the local Durham Coal and Iron Company employing about 500 miners.

The leadership of the bank included its cashier, W.H. Crow, who moved to the town from Birchwood in 1915. Crow built a home in Soddy, became politically active, and was known as Squire Crow, being a member of the County Court (effectively the County Commission in today's terms) from 1918 to 1926.

By late January 1930, the prosperity of the small town of about 1,950 residents had faded. The stock market crash in October 1929 launched the financial spiral that started the Great Depression. The Durham Coal and Iron Company went out of business that fall. The only industrial concern still going in the small town was the hosiery mill, and "from this industry the business the town was said to be kept alive." Further, there were conflicting indications about the continued viability of the Soddy Banking Company. On the one hand, state bank examiners had been in the bank in late 1929 and found no issues, and at a mid-January board meeting of the bank, Crow reported that the bank was in good shape. On the other, an effort was made in the previous weeks to sell the company to Hamilton Bank in Chattanooga, which declined the transaction because of the "industrial reverses" in Soddy.

Read more Chattanooga History Columns

- Gaston: Paul John Kruesi was Edison's right-hand man

- Robbins: The old Richardson's house and the Civil War

- Gaston: James Williams was a man of the world

- Raney: Mason Evans, the 'Wild Man of the Chilhowee'

- Gaston: The legacy of Adolph Ochs endures

- Martin: Ed Johnson said, 'I have a changed heart,' the day before his lynching in Chattanooga on 1906

- Thomas: The inventiveness of Judge Michael M. Allison

- Moore: Chattanooga's first Chinese community

- Summers, Robbins: Chattanooga's Tuskegee Airman - Joseph C. White

- McCallie: The Civil Rights Act of 1964 says so!

- Gaston: John McCline's Civil War - from slave to D.C. parade

- Raney: Exploring Chattanooga businesses in the Green Book

- Elliott: Remembering the Freedmen's Bureau in Chattanooga

- Gaston: Nancy Ward was a beloved, respected Tennessean

- Martin: Prohibition - the noble experiment

- Elliott: 'A shameful, disgraceful deed': The destruction of the Sewanee cornerstone

- Gaston: Robert Cravens was ironmaster, Chattanooga area's first commuter

- Robbins: Dr. T.H. McCallie's Christmas 1863

- Robbins: Journalist writes of a trip to Missionary Ridge in 1896

- Summers, Robbins: Mine 21 disaster - gone but not forgotten

- Elliott: Collegedale incorporates to avoid Sunday 'blue laws'

- Gaston: 'Marse Henry' Watterson's journalism fame began in Chattanooga

- Robbins: Orchard Knob battle recalled in 1895

- Elliott: Chattanoogans joined in an 'orgy of joy and gladness' on Armistice Day, 1918

- Thomas: Noted service, speakers are marks of Rotary Club of Chattanooga since 1914

- Summers and Robbins: Remembering noted Tennessee author North Callahan

- Raney: 'I auto cry, I auto laugh, I auto sign my autograph'

- Gaston: Sequoyah's alphabet enriched Cherokees

- Robbins: A look at Sam Divine's life during the Civil War

- Robbins: Memories of a Confederate nurse

- Robbins: More notes from Bradford Torrey's 1895 visit to Chickamauga Battlefield

- Robbins: Journalist in 1895 details visit to Chickamauga Battlefield

- Elliott: Telephone exchange firebombing was distraction for grocery store robbery

- Gaston: Worcester brought Christ's message to Cherokee at Brainerd Mission

- Robbins: 1896 travel diary: 'A Week on Walden's Ridge'

- Gaston: Elizabeth Strayhorn, WAC Commandant at Fort Oglethorpe

- Robbins: The history of the Friends of Moccasin Bend National Park

- Moore: Do you own a Sears Roebuck home?

- Summers and Robbins: Camp Nathan Bedford Forrest in World War II

- Gaston: Hiram Sanborn Chamberlain remembered

- Elliott: Daisy the center of tile, ceramic manufacturing in Hamilton County

- Gaston: FDR inaugurates the Chickamauga Dam

- Summers, Robbins: Interned WWII Germans had it easy at Camp Crossville

- Elliott: A war correspondent on Lookout Mountain

- Gaston: Chickamaugas finally bury hatchet in Tennessee Valley

- Gaston: Chickamaugas in Chattanooga

- Robbins: The history of the Riverbend festival

- Raney: Sadie Watson, the first woman elected in Hamilton County government

- Moore: Remembering Chattanooga's Hawkinsville community

- Elliott: Welsh coal miners transformed Soddy after the Civil War

- Gaston: Chattanooga's best-kept secret

- Elliott: Cabell Breckinridge loses his horse

- Raney: Martin Fleming is the people's judge

- Gaston: The amazing career of Francis Lynde

- Martin: Hamilton County's Name Sake: Alexander Hamilton

- Summers, Robbins: The crosses at Sewanee

- Bledsoe: The fiery truce at Kennesaw Mountain

- Moore: Talented architect's life cut short by tragedy

- Rydell: Chattanooga's place in soccer history

- Robbins: Tennessee Coal, member of the First Dow Jones Industrial Average

- Raney: In the barber chair

- Lanier: Becoming the Boyce Station Neighborhood Association

- McCallie: John P. Franklin: Living history among us

- Barr: Chattanooga's first railroad: The Underground Railroad

- Summers, Robbins: Charles Bartlett was a Pulitzer Prize winner, Kennedy confidant

- Rainey: 'We have seen it'

- Elliott: Feinting and fighting at Running Water Creek and Johnson's Crook

- Gaston: The Spring Frog Cabin at Audubon Acres

- Raney: Wauhatchie Pike was moonshine motorway

- Robbins: Oakmont was home of venerable Williams clan

- Summers and Robbins: Rebirth of the Mountain Goat Line

- Elliott: Bad investments led to Soddy Bank failure in 1930

- Summers and Robbins: Pearl Harbor attack left football behind

- Gaston: Jolly’s Island namesake had long ties with Sam Houston

- Return Jonathan Meigs, Indian Agent

- Moore: Did you know about St. Elmo's other two cemeteries?

- Summers: Orme - Marion County's almost lost community

- Davis: Spooky revival at Sharp Mountain in 1873

- Robbins: The story of Longholm

- Raney: Women labored to help the U.S. win World War I

- Even in the city, the 'wheel' changed everything

- Murray: Confederate dilemma after Chickamauga

- J.B. Collins — Newsman extraordinaire

- Robbins: The Story of the Lyndhurst Mansion

- Chattanooga artist and wife lost on the Lusitania

- Chattanooga History Column: Battelle, Alabama and the Battelle Institute

- John Ross, a founder of Chattanooga

- Hamilton County casualties in World War I

- Chattanooga Power Couple

- 'Somewhere in France'

- The Ray Moss family

- Battery B from Chattanooga

- Ulysses S. Grant, Clark B. Lagow, and the Chattanooga Bender

- Songbirds Museum Timeline

- Hamilton County World War 1 roster

- The Soddy Girl and the Memphis Belle

- Blues icon Bessie Smith was the Empress of Soul

- Women's Army Corps at Chickamauga

- Emma Bell Miles' life at the top of the 'W'

- The Tivoli Wurlitzer is one of Chattanooga's priceless assets

- Chattanooga in struggle for freedom during Civil War

- October 1918, Chattanooga paralyzed by Spanish flu epidemic

- Eli Lilly and the Ditch of Death

- One hundred years ago, Chattanooga goes to war

- The legacy of Anna Safley Houston

- Harriet Whiteside was ahead of her time

- Southern Adventist University

- Chattanooga native's writings aided Civil Rights movement

- Zion College, Chattanooga's only African American College

- The North Shore's hidden past

- Mayme Martin -- Businesswoman and community leader

- Thomas Sim's epic struggle for freedom

- Top of Cameron Hill was price of rerouting interstate

- Cameron Hill has rich history

- Temperance movement included Harriman university

- The sweetest music this side of Heaven

- Conquistadors at Chattanooga

- Chattanooga and the 'General'

- Chattanooga's first Thanksgiving, 1863

- Chattanooga's greatest flood caught city unaware

- Opening the Cracker Line

- European trip in 1900 enlightens Sophia Scholze Long

- Sophia Scholze Long spoke out when others were silent

- Little South Pittsburg and its big silent movie stars

- Lot attendant recalls hottest job in Chattanooga

- Chattanooga's Forest Hills is final resting place for known, unknown

- Burritt College -- Pioneer of the Cumberlands

- Chattanooga's nicknames trace city's evolution

- The 25th annual meeting of the Tennessee Press Association

- Clemons Brothers Furniture Store

- The Short Life of the USS Chattanooga

- Ellen Jarnagin McCallie lived a truly remarkable life

- Dr. Jonathan Bachman was a revered city father

- Second guessing the Confederate failure on Missionary Ridge

- Nancy Kefauver, ambassador for the arts

- William Gibbs McAdoo kept his Southern roots

- Chattanooga's Secretary of the Treasury

- Howard Baker remembered as a statesman/photographer who snapped history

- Tivoli's last picture show

- The history of one of Chattanooga's oldest businesses

- Chattanooga's roller derby skaters

- Myths of Coca-Cola in Chattanooga

- Chattanooga's neighborhood grocery stores

- The tale of the Scottsboro Boys

- The people's history of Chattanooga

- Howard School is Chattanooga's reminder of Reconstruction

- Elevator operator, painter, mystery man: meet Rice Carothers

- Raulston Schoolfield made enemies amid his rise to power

- Website lets users peer into Chattanooga's past

- The flood of 1917

- Chattanooga's 'wickedest woman' buried at Forest Hills

- History of Cummings Highway

On Jan. 24, a Friday, Crow purchased a bottle of carbolic acid from a druggist in Soddy and departed for Kissimmee, Fla., where his parents lived. Either intentionally or accidentally (Florida authorities determined it was the latter), Crow ingested some of the poison and died early on Jan. 28, a Tuesday. But also on the 24th, the county trustee at the Hamilton Bank tried to cash a check drawn on the Soddy bank. That was refused, and when the check was presented at the Soddy bank on the following Monday, it was dishonored. Crow was notified and promised to return but died the next day. Crow had apparently concealed the true status of the bank from its employees. The directors of the bank notified the state superintendent of banks that it could no longer meet its business in due course and asked that the superintendent take over its affairs for liquidation.

Rumors ran rampant, the wildest of which was that Crow had faked his death to escape prosecution. A bank in neighboring Daisy had to be closed for a few days because of fears that it, too, was insolvent. The loss was attributed to Crow's bad investing, such as in peach orchards, or having secretly spent the missing money in "fighting a political faction." Money was supposedly lent without collateral, and the closing of the Durham Coal and Iron Company was considered to be a factor in the bank's failure.

While a number of creditors, such as the county trustee, were secured by bonds, a great number of small depositors suffered loss, some to the point of destitution. Newspaper accounts noted the losses of a disabled miner and a Presbyterian minister and stated that school teachers seem to have been particularly hit hard. Reportedly, depositors eventually got a small percentage of their monies back in the liquidation.

The elegant Soddy Bank building remained, but it never again housed a bank. It served for many years as an appliance store and later as a photography studio. Happily, in approaching its 100th birthday, the building has been put to use as a local history museum operated by the Soddy, Daisy & Montlake Historical Association. The museum opened on July 1, 2017, and will close on Dec. 23 so that new exhibits can be readied for a reopening in the spring of 2018.

Sam D. Elliott is a local attorney and a member and former chairman of the Tennessee Historical Commission. He is the author of a new book, "John C. Brown of Tennessee: Rebel, Redeemer and Railroader." For more visit Chattahistoricalassoc.org.