Final judgments totaling $65 million have been entered in a case against two business entities tied to John J. Woods, the former Chattanooga Lookouts investor alleged by regulators to have run a massive Ponzi scheme.

The entities are to give up that amount by forfeiting profits or paying penalties, according to an order by U.S. District Court Judge Steven D. Grimberg of Atlanta.

The amounts will be satisfied by how much is collected from the ongoing sale of the entities' assets, court papers said. Those assets are to be distributed to claimants who invested with Woods.

Still pending is the U.S. Securities and Exchange Commission's August 2021 complaint against Woods.

The judgments were entered in the case against the two entities that regulators claim Woods used to help facilitate the alleged Ponzi scheme -- Southport Capital and Horizon Private Equity III.

Both Southport and Horizon consented to the judgments' entry without admitting or denying the SEC's allegations, and they waived their rights to an appeal.

Woods, 57, who grew up in East Ridge before moving to Marietta, Georgia, has denied wrongdoing in court papers.

In the judgments, Horizon is to give up more than $49.4 million in net profits plus $11.4 million in interest. Southport Capital was hit with a $5 million civil penalty.

In the SEC's 2021 complaint, regulators accused Woods of running the scheme for over a decade that defrauded more than 400 investors and continued to raise more money to try to pay off previous investors.

In the 40-page complaint filed in federal court in the Northern District of Georgia, the SEC accused Woods and the Chattanooga-based Southport Capital investment firm of six counts of securities fraud. The complaint said Woods' scheme, which used the Horizon investment fund, collected more than $110 million from investors with promises of 6-7% rates of return.

The SEC said in court filings that the investments "are worth far too little for there to be any realistic prospect that the Ponzi scheme will be able to pay back existing investors their principal, let alone the promised returns."

Attorney David M. Chaiken of Atlanta, who is representing Woods and Horizon, said earlier in an email that the SEC's claims don't meet the FBI's definition of a Ponzi scheme.

He said government regulators' "use of this pejorative term in its press release and in its complaint mischaracterized the actual facts and unfairly portrayed" Woods and others. Chaiken said Woods had been managing a private equity fund with real assets that would have been worth more than what the fund owed investors.

Chaiken didn't return an email this week seeking comment on the Horizon judgment.

An SEC spokesman this week declined to comment on the judgment beyond court filings.

In a Zoom court hearing in September, a receiver earlier appointed by the judge to sell the assets said investors who were allegedly defrauded could see some money back before the end of this year.

The receiver, attorney A. Cotten Wright, of Charlotte, North Carolina, said there could be two or three instances of distributions to investors.

Wright said in September that the latest accounting showed claims of $70 million by 431 investors, but it remained to be determined how much claimants will receive.

She said claims ranged from about $85 to $4.6 million at the highest amount, which was $3 million more than the second largest.

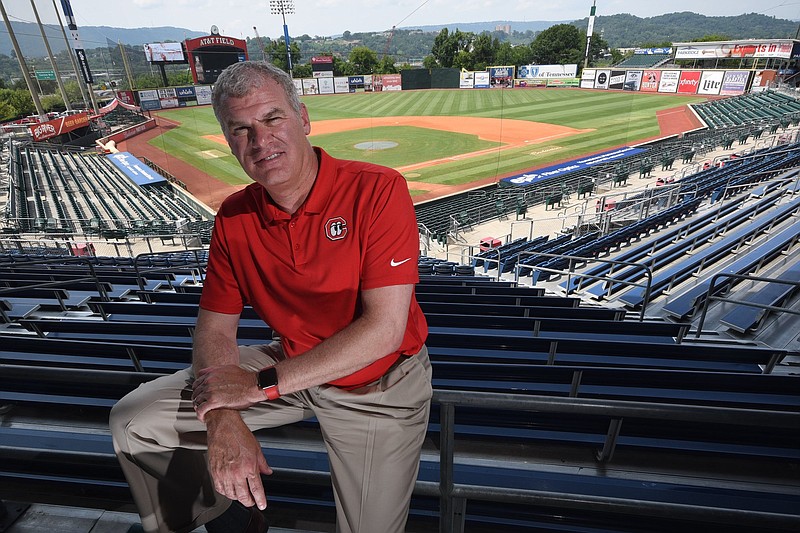

Woods' assets that the receiver has worked on liquidating include his stake in Southport Capital, where he was chief executive at one point.

Woods' Horizon fund, among other investments, had included interests in Chattanooga area entities such as real estate ventures involving strip centers and the former Sears and JCPenney stores at Northgate Mall.

In October 2021, the judge agreed to let the Lookouts buy Woods' share in the club for $1.87 million.

Contact Mike Pare at mpare@timesfreepress.com or 423-757-6318. Follow him on Twitter @MikePareTFP.