Investors who federal regulators say were defrauded by a Georgia man with holdings in Chattanooga could see some money back before the end of the year, the receiver in the case said Friday.

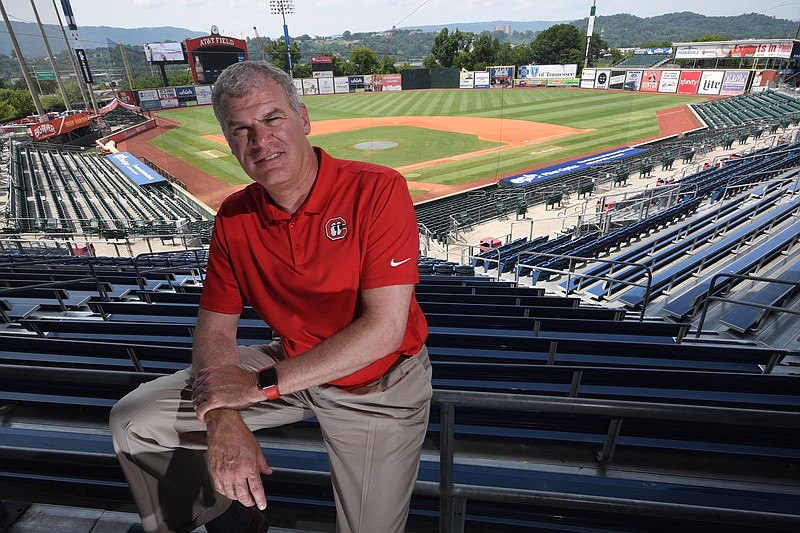

U.S. District Court Judge Steven D. Grimberg of Atlanta, during a hearing on Zoom, said he would enter an order approving the receiver's distribution method in the case of John J. Woods. He is the former Chattanooga Lookouts minority owner who last summer was accused of running a massive Ponzi scheme by the U.S. Securities and Exchange Commission.

The court-appointed receiver, attorney A. Cotten Wright, of Charlotte, North Carolina, said there could be two or three instances of distributions of money to investors. She is selling off assets in which Woods had invested over the last decade or so as he operated the Horizon Private Equity III fund.

Wright said the latest accounting shows claims of $70 million by 431 investors, but it remains to be determined how much claimants will receive.

The Securities and Exchange Commission in August 2021 alleged in a complaint that Woods, who lives in Marietta, Georgia, but grew up in East Ridge, had operated the fund with promises of 6% to 7% returns to investors.

But the SEC in court filings alleged that investments Woods made in a number of companies and in real estate deals, several in the Chattanooga area, were worth far too little for there to be any realistic prospect of paying back investors their principal, much less the promised returns.

Woods in court papers has denied the allegations of running a Ponzi scheme and asked for a jury trial in the civil case. Woods has not been criminally charged.

His attorney, David M. Chaiken of Atlanta, said the SEC's claims don't meet the FBI's definition of a Ponzi scheme and that government regulators' "use of this pejorative term in its press release and in its complaint mischaracterized the actual facts and unfairly portrayed" Woods and others.

During the hearing, the judge said that calling the fund a Ponzi scheme is not something on which all the parties agree.

Wright said she has tried to use "alleged Ponzi scheme." But whether or not it's called that term, she said it's evident that the Horizon investor money was not invested in income-producing vehicles that were throwing off enough to produce 5% to 6% interest per month.

"Money transferred for investor accounts had to come from somewhere, and best I can see, it wasn't coming from investments," she said.

Chaiken said in an earlier email that Woods was managing a private equity fund with real assets that would have been worth more than what the fund owed investors.

SEC attorney Harry B. Roback on Friday said he had no objection to the proposed method of distributing money to claimants, nor did Chaiken.

The receiver proposed using a "net investment method" to calculate distributions to investors on allowed claims. In this method, funds are distributed on a pro-rata basis relative to the allowed claim amounts.

Wright said claims range from about $85 to $4.6 million at the highest amount, which is $3 million more than the next largest.

Woods' assets that the receiver has worked on liquidating include his stake in a Chattanooga investment firm, Southport Capital. Woods was chief executive at one point for the company, which also was accused of fraud by the SEC, an accusation the company's attorney denied.

Woods' fund, among other investments, had included interests in Chattanooga area entities ranging from the Lookouts to real estate ventures involving strip centers and the former Sears and JC Penney stores at Northgate Mall.

In the SEC's original complaint, it had sought civil penalties, the giving up of "ill-gotten gains" and a freezing of Woods' assets.

Contact Mike Pare at mpare@timesfreepress.com or 423-757-6318. Follow him on Twitter @MikePareTFP.