The Tennessee House is maintaining its distance from the Senate with a franchise tax cut that would give one-year rebates totaling $700 million, in addition to requiring businesses that seek the money to be identified on the state's website.

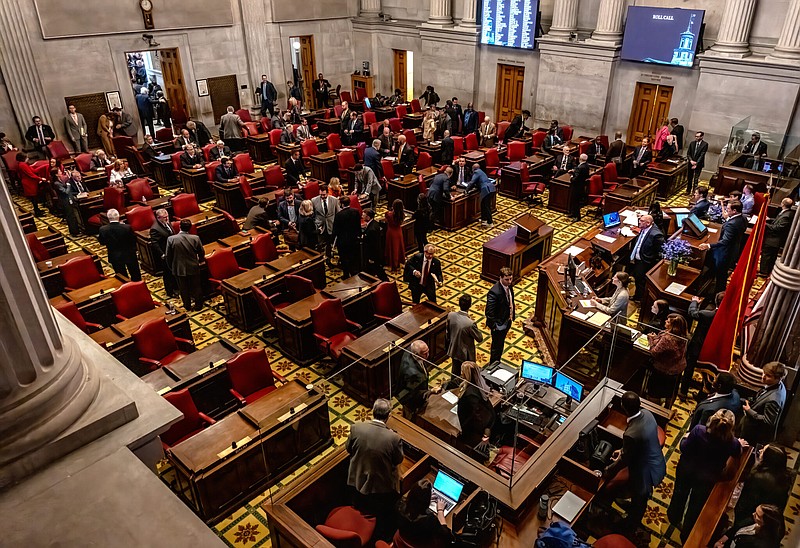

House finance committee members approved the measure Tuesday on a voice vote, sending House Bill 1893 to the floor for consideration.

The move came even though Democratic Rep. Sam McKenzie, of Knoxville, said businesses should be ashamed to be threatening lawsuits over the property value portion of the franchise tax in what he termed a "tax-averse" state.

"This is wrong for us to be sitting here in this position," McKenzie said.

Rep. Bob Freeman, a Nashville Democrat, also predicted the financial burden for the state would wind up being much greater than projected.

Though legislative leaders have said consistently no lawsuit is pending over the state's franchise tax structure, Gov. Bill Lee's administration said 80 businesses had raised the specter of requesting tax rebates based on the ruling from a 5-year-old Supreme Court case out of Maryland.

Subsequently, the attorney general's office and Revenue Department recommended a three- to four-year rebate expected to cost $1.5 billion, plus $400 million annually in foregone revenue.

Senate leaders are going along with Lee's plan, passing it in late March. But the two chambers remain far apart on the measure.

Lt. Gov. Randy McNally, of Oak Ridge, said recently the Senate could agree with the transparency portion of the House bill but likely would balk at portions dealing with the time frame for rebates.

In addition to the transparency portion of the bill, the House legislation would prohibit businesses from suing the state if they apply for and receive a rebate.

House Majority Leader William Lamberth, who is sponsoring the bill for Lee, told committee members he considers the tax cut a "policy determination" and claimed he isn't affected by "saber rattling."

(READ MORE: Tennessee financial officials urge calm over state's flattening revenue)

Nevertheless, Lamberth, a Portland Republican, said it would be a bad idea for any business to sue the state.

"Bring it. We've got a whole tower full of attorneys over here who will fight you every step of the way, and five or six years from now, some judge might give you a penny or two that your lawyer's going to take a bunch of," Lamberth said.

Some critics of the legislation have said the state should let businesses file suit anyway and let the courts decide whether Tennessee's franchise tax is constitutional.

Read more at TennesseeLookout.com.